Drip Drip Drip

- Apr 4, 2019

- 2 min read

Drip Drip Drip

Dividend Reinvestment Plans

At the risk of sounding like a weird, cat household, my wife, Michelle, has a tender spot for strays. Not only did she shelter Catherine, but she’s fostered a pesky habit of feeding any and all ferals who stumble in our yard. Now that the word is out, we may see 3 or 4 different ones a day; our pantry has become Petco. Michelle has developed an exceptional affinity for a distinctive, calico kitten. She even shared the tidbit that 1 in 3000 calicos is male[i]. I’m guessing this one is female. Our blog has hit rock bottom.

Unfortunately, this particular calico has become affectionate towards her. This is exactly how Catherine weaseled her way indoors. Oh, I forgot to mention: we spent a fist full[ii] on her in January - to have leftover gauze removed from a poorly executed spaying. Still yet to see any semblance of ROI on Catherine, Michelle wants to double down with another feral. All this nonsense has me wondering if it’s logical to question automatic reinvestment plans. I’m actually questioning a lot of things.

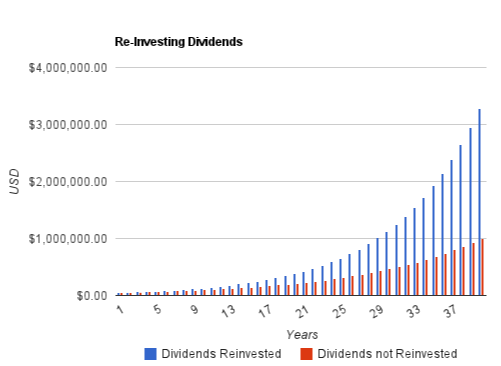

Intentional or not, most of us utilize Dividend Reinvestment Plans through our 401k’s, IRA’s or general investments. It automatically buys additional shares anytime there is an income or capital gains payment, usually transaction cost free. DRIPS are simple, cost effective and avoid the emotional timing issue of when to buy. Numerous studies have calculated the long term, monetary benefits of automatically reinvesting dividends vs. taking them as cash. The graph below shows an average growth & income fund yielded 300% more over 40 years when dividends and capital gains were reinvested vs. leaving as cash.

|

|

Comments